Maintaining healthy cash flow in your business is essential for several reasons, primarily to ensure smooth operations and financial stability. A consistent and positive cash flow allows your business to meet short-term financial commitments, such as payroll, rent, and inventory purchases, safeguarding it against liquidity crises. Additionally, it provides the flexibility to capitalize on investment opportunities, fuel growth initiatives, and innovate without relying heavily on external financing. In essence, improving cash flow isn’t just about survival but also about enhancing business agility and resilience, as well as improving growth opportunities.

Refining and optimizing business processes can lead to improved cash flow, and in this context, the power of productivity mining cannot be underestimated.

Understanding Productivity Mining in the Context of Cash Flow

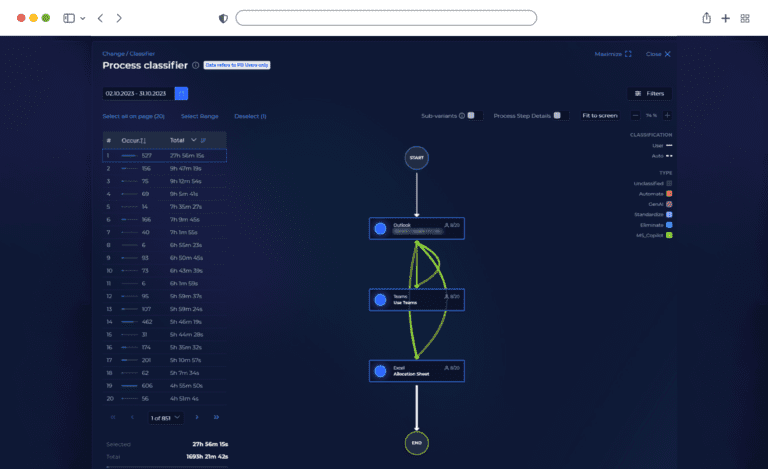

Productivity mining, which encompasses task mining, dives into the details of how employees perform operations. It captures interactions within process swim lanes and with software applications, helping identify inefficiencies that may be affecting critical financial processes. When it comes to cash flow, these inefficiencies can result in payment delays, invoicing discrepancies, errors, and other disruptions that hinder the smooth flow of money.

The Impact of Productivity Mining on Receivables and Collections

One of the key areas where cash flow can be enhanced through productivity mining is in receivables and collections. By pinpointing process bottlenecks, productivity mining enables businesses to identify what’s causing delays in invoicing or which steps in the collection process are cumbersome. Addressing these issues directly leads to faster collections, a crucial factor for maintaining positive cash flow.

Optimizing Payments with Productivity Mining Insights

Effective and efficient payment processing, both from customers and to suppliers, can expedite the cash flow cycle. Productivity mining can help in several ways:

- Identifying process delays: Productivity mining can identify the root causes of delays in payment processes, including invoicing, order acceptance, or payment processing. Eliminating these delays accelerates cash flow.

- Automatic detection of process deviations: Productivity mining insights make deviations from standard processes visible, including shortcuts taken by staff that could create regulatory risks. Visibility into processes allows managers to see the deviations and address them.

- Tracking error sources: Productivity mining helps organizations identify the sources of errors in payment processes by retracing steps to find the source. These insights empower the company to focus on specific steps to prevent errors in the future.

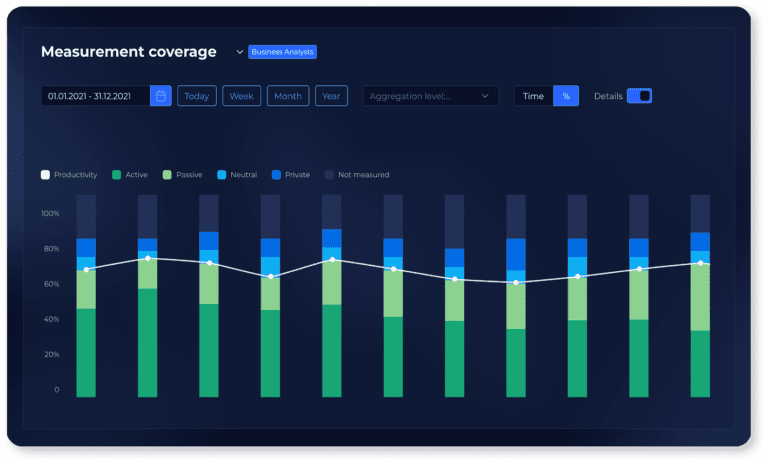

Embracing Real-time Cash Flow Visibility

The real-time insights provided by productivity mining are a game-changer. By offering businesses a real-time view of processes involving cash inflow and outflow, productivity mining tools enable informed, data-driven decisions. Decision-makers gain visibility into finance processes and can eliminate hidden bottlenecks, thereby improving cash flow.

Productivity Mining in Cash Flow – A Catalyst for Business Growth

Productivity mining, when applied to cash flow, can be a potent catalyst for business growth. The benefits include:

- Shortening cycle time and revenue assurance: By optimizing financial processes, companies can reduce the time needed to complete transactions, from invoicing to receiving payments, thereby improving financial liquidity.

- Enhancing relationships with customers and suppliers: Streamlined financial operations lead to better relationships with customers and suppliers. Timely payments and accurate settlements build trust in business relationships.

- Risk management optimization: Productivity mining can make financial risks visible, such as payment delays that can result in penalty charges. This allows appropriate risk mitigation strategies to be implemented.

- Augmenting skills in the finance department: Productivity mining analysis can identify process steps that can be automated with intelligent automation technologies or employee skills augmented with online help and other tools, such as instant translation of text. By automating mundane tasks and providing easy access to augmentation tools, such as online help chatbots, employees can become more productive and focus on higher-value tasks.

Productivity Mining: Your Tool for Continuous Cash Flow Improvement

It’s essential to understand that cash flow optimization is an ongoing task. As businesses evolve, so do their financial processes. This is where the continuous monitoring capability provided by productivity mining offers additional benefits. By regularly assessing and refining processes, businesses can ensure that their cash flow remains robust and resilient.

Productivity Mining – The Future of Cash Flow Management

Productivity mining can play a critical role in cash flow management. By offering in-depth insights, identifying inefficiencies, and allowing for real-time monitoring, productivity mining equips businesses with the tools they need to maintain a steady and reliable cash flow.

If you’re looking to optimize your business’s cash flow, it’s high time to explore the world of productivity mining. Contact us to find out more about the KYP.ai Productivity Mining 360 platform.

Discover Your Productivity Potential – Book a Demo Today

Book Demo